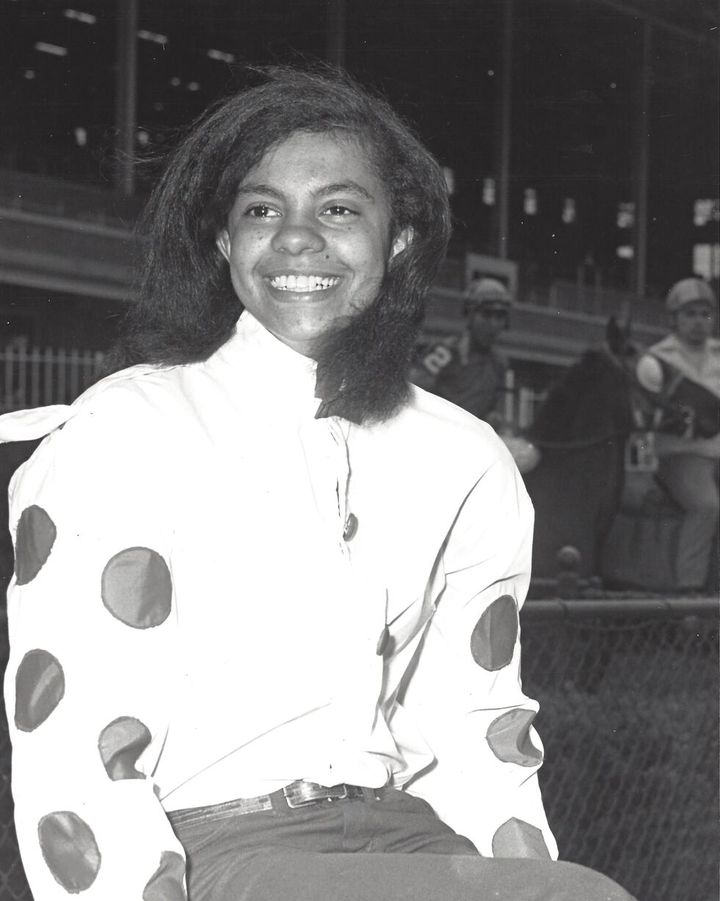

At just 26, Terri Burns is already making a name for herself in the venture capital space.

After joining GV, formerly known as Google Ventures, in 2017 as a principal on the investing team, Burns has worked her way up to become the firm’s youngest and first Black female partner. When thinking of her new role and the glass ceiling she’s shattered, Burns says there are three words that come to mind: excitement, gratitude and responsibility.

“There’s a part of me that’s like, ‘It’s really great that we are moving into a space where different types of people — young people, folks of color — are getting a seat at the table and having lots of opportunities,’” she tells CNBC Make It. But with these opportunities, she says, also comes “a little bit of weight, where you want to make sure that you are paving the way for others.”

“This is an exciting moment that I’m grateful for and looking forward to,” she says. “But I also feel like there is still a lot of work to be done and that’s something that I feel very dearly and take very seriously.”

In the past few years there’s been very slow progress increasing female representation in the venture capital world. At the end of 2017, just 9% of VC firms had female partners. As of February 2020, that number had increased to 13%, according to All Raise, a nonprofit that works to increase the success of women founders and funders. Just two women who identified as Black or Latinx were appointed partner at a VC firm in all of 2019, reports All Raise.

Reflecting on her own career journey, Burns says there are a lot of people who helped pave the way for her to be at GV today.

After graduating from New York University with a bachelor’s degree in computer science in 2016, Burns set her sights on moving to Silicon Valley to work in tech. That same year, she landed a job at Twitter working as an associate product manager. During that time, she connected with a partner at GV who had worked in product management for many years and offered to give Burns more insight into the industry and their career journey.

“I ended up actually coming to GV a handful of times to learn more about product strategies,” Burns says. “And then at one point, the partner said, ‘Hey, we’re hiring for the investment team and you would be a great fit.’”

At the time, Burns says she still knew very little about venture capital and had no clue what her role at GV would entail. But after speaking with a few people on the team and going through the recruitment process, she joined the firm in October 2017.

“Early on [at GV], a lot of my work really focused on helping to source deals and helping to support the partners in the work they were doing,” she says of her starting role as principal on the investing team. “There was a ton of mentorship and there was a lot of learning on my end, and then over the course of the last few years the scope of those responsibilities increased.”

Now, as partner on the investing team, Burns is responsible for adding to GV’s portfolio and writing checks to entrepreneurs. This year, she’s done two deals, one that hasn’t been announced yet and the other is a $1 million investment in Have a Great Summer (HAGS), a Gen-Z founded company that builds creative and fun digital experiences for Gen-Z students. This summer, HAGS launched its first product, a yearbook app that allows thousands of high school students to sign their yearbook through Snapchat.

In a GV blog post, Burns explained that she first heard about HAGS through peers in her circle, which prompted her to reach out to the founders for virtual coffee. During that meeting, she says she learned that the founders were “incredible consumer product thinkers” and she was happy to ”[jump] at the opportunity to lead the company’s seed round.”

Burns says her investment in HAGS is aligned with GV’s goal to tap more into the Gen-Z space as this young generation is already “building a lot of tools that are shaping the cultural landscape.”

“It’s something that I’m also personally interested in because a lot of my peers and friends who I see building technologies are also Gen-Z,” she adds.

Overall, Burns says she’s proud of the work GV is doing, and she’s excited about the opportunity to invest “across the board in all different type of companies.”

“I want to make sure that I always have a really diverse portfolio,” she says. “I love consumer companies. I love mobile companies, and I think I’ll probably look more into the Gen-Z market. I’m also really interested in enterprise companies and I think fintech is really fascinating, too.”