Half of Tesla’s profits do not come from electric vehicles, and if it weren’t for this “invisible” product, Elon Musk’s empire would probably be in even worse shape.

Recently, electric car company Tesla announced its financial report for the second quarter of 2024, showing that Elon Musk’s empire earned up to 890 million USD from selling something that doesn’t exist: carbon credits.

Thanks to the sale of carbon credits, Tesla’s total revenue in the second quarter of 2024 reached a record $25.5 billion, according to Business Insider (BI). However, the company’s net profit was only $1.48 billion, down 45% compared to the same period last year.

lucrative business

Carbon credits are something that does not exist, but simply offset the difference in the amount of greenhouse gas emissions that are released into the environment according to regulations.

Because Tesla is a 100% electric car company, the company has excess carbon credits, meaning it emits less greenhouse gases into the market than the standard level, which it can then sell to gasoline car companies in need.

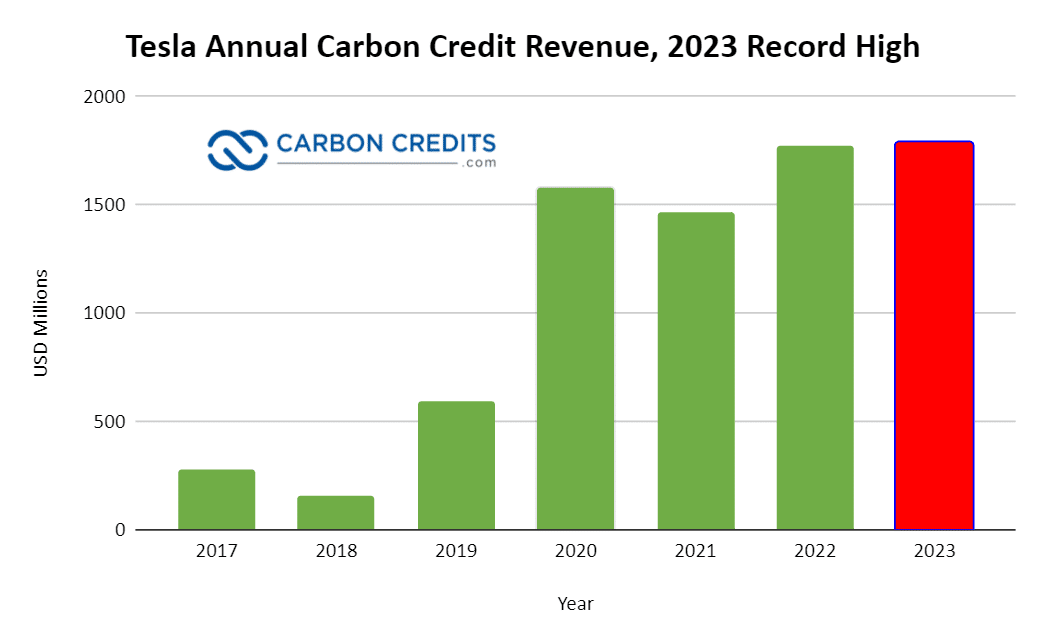

Tesla’s carbon credit revenue hits record high in 2023

By selling carbon credits to gasoline-powered automakers that have yet to reduce greenhouse gas emissions to regulatory levels, Tesla doubled its sales from this segment compared to the previous quarter.

According to BI, while automakers are struggling to develop electrification, Tesla has earned up to 1.79 billion USD from selling carbon credits in 2023, bringing the total revenue of this segment from 2009 to present to nearly 9 billion USD.

Because there are no production or operating costs, the money from selling carbon credits becomes almost pure profit for Tesla, thereby helping Elon Musk escape the misery of being criticized by shareholders when profits decline.

So the $890 million in the second quarter from selling carbon credits accounted for half of Tesla’s net profit.

In fact, in 2020, Tesla’s former CFO Zachary Kirkhorn warned that the company was relying too much on carbon credits rather than electric vehicles, and predicted that revenue from this segment would gradually decline over time as many competitors also began electrifying their cars.

Ironically, the slowdown in the electric vehicle market has kept Tesla’s carbon credit revenue growing at the same rate.

Dramatic

CNBC news agency said that despite selling a lot of carbon credits and reaching record revenue, Tesla’s profits still decreased.

The main reason comes from Elon Musk burning money to develop artificial intelligence (AI) technology, aiming for self-driving electric cars, along with the price war of electric cars, causing profits to be eroded.

Unit sales of Tesla’s best-selling electric cars have been falling over the past year, thanks to Elon Musk’s aggressive pricing policies. Consumers feel that electric cars are too expensive and can be discounted further, while others worry that their Teslas will lose value even more.

Tesla’s electric vehicle sales revenue fell 7% in the second quarter of 2024 compared to the same period last year, equivalent to the second consecutive quarter of decline due to strong competition from Chinese rivals.

The company has had to extend its zero-interest installment purchase program in China, which was launched in April 2024, to stimulate sales amid pressure from domestic electric vehicle brands.

Meanwhile, Tesla’s operating expenses increased 39% year-on-year to $2.97 billion. Elon Musk’s empire’s total AI technology construction cost in the second quarter was $600 million. The Tesla boss even announced that he would invest up to $10 billion in AI by 2024.

After years of double-digit growth, Elon Musk has warned that Tesla will slow down this year with operating margins falling to single digits.

Tesla’s global unit sales fell 6.5% to just 830,766 electric vehicles in the first half of this year as demand in the market weakened.

In the US alone, Tesla’s unit sales fell 17% in the first six months of the year, even though this is the electric car company’s largest market.

Tesla’s stock price fell 8% immediately after the financial report was released.